Business Decisions Made Easier With Reliable Big Data Analytics

Business Decisions Made Easier With Reliable Big Data Analytics

Big data has become the business buzzword today as enterprises are adopting an innovative approach to storing and using data. The immense volumes of structured and unstructured data are being treated as a business asset. However, there is a need to understand how this data can be used to one’s advantage. Businesses are thus adopting advanced big data solutions that are capable of leveraging it for delivering sustainable results. At OrangeMantra, we extend a broad set of big data services to enable the clients to compile disparate data and use it as powerful business insight for taking profitable business decisions.

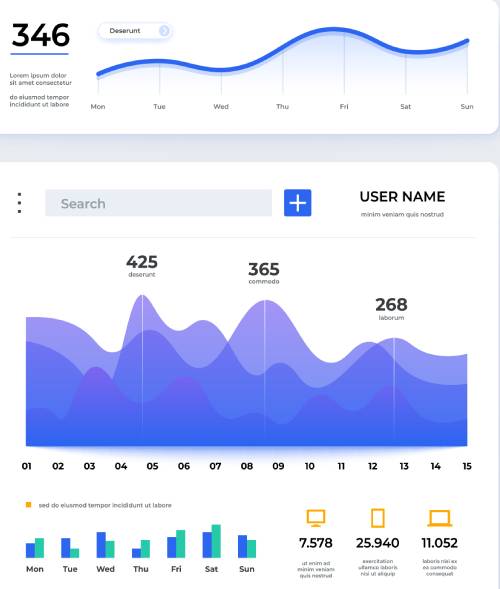

We serve automated solutions that convert large amounts of complex data into user-ready data sets. This empowers the business owners and analysts to effectively collect, analyze, visualize, and manage data across multiple sources. Our solutions aim to transform the data sets into intuitive and useful visualizations, dashboards, and reports that serve as valuable business insights. With these impactful insights, the business owners can easily identify their strengths and weaknesses and take the necessary initiatives to bring about influential results.

Our Big Data Analytics Solutions Enable Our Clients to

- Find the right data collection method that will form as the core element of your data-gathering strategy.

- Perform comprehensive data analysis to extract realistic and actionable insights to overcome complex business challenges.

- Implement thoughtfully-designed big data solutions to protect, grow, and tweak your business operations and gain a competitive edge in the market.

Explore Our Wide Array of Big Data Analytics Services

Predictive Analytics

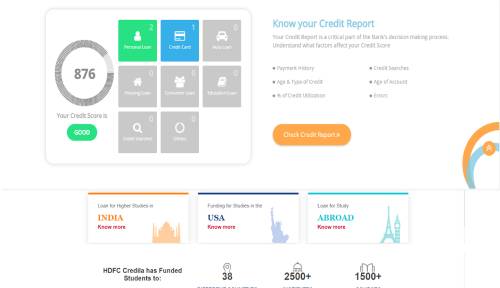

A predictive analysis encompasses a variety of data analytics techniques from data mining, statistics, modeling, machine learning, and artificial intelligence to analyze current and historical data to predict future behavior, patterns, and outcomes based on facts and figures. This forward-gazing technique is beneficial for businesses as it helps them to detect and combat risks, prevent fraudulent behaviors, discover opportunities, develop business strategies, and so on. Our team of experienced data analysts provides reliable predictive analytics that enables businesses to find patterns and recognize the potentials of their business value.

Data Visualization and Reporting

To obtain a clear understanding of the data, it is essential to represent data using interactive visualizations and filters. An intelligent and informative representation of data enables business leaders to extract meaningful information and use it to enhance their business strategies. Our data visualization professionals use their creativity and expertise to profile your data using various visual elements including bar charts, infographics, scatter plots, heat maps and other data visualization tools to provide you with an accessible way to unlock hidden value, identify and understand trends, uncover new insights, outliers, KPI’s and patterns in data and build your own data-driven decision support system.

Data Migration and Integration

Our team of data migration and integration specialists helps you to upgrade your databases and legacy system and reap the benefits of digitalization by migrating your existing business data and content through automated processes. Our team will work closely with you to help you optimize your data migration and integration processes to enable quick and easy migration with minimal disruption. With our effective data migration and integration service, we ensure that the system performance, security, and maintenance are carefully monitored within the stipulated migration timeframe.

Architecture Assessment and Advisory

From assessing your existing system and its drawbacks to architecting the infrastructure, implementation, support and maintenance, our complete suite of architecture assessment and data advisory solutions are meant to cater to all your business’ IT requirements. We are backed by a dedicated team of data advisories that is well-versed with the technical know-how and has the collaborative spirit necessary to perform an extensive assessment IT environment. Our team of data advisories will dive deep into your existing data to check the health of your information, identify potential risks and restructure its design.

Advanced Big Data Analytics

Be it enhancing the sales process or automating a manufacturing plant, we develop customized software solutions featuring ML. We leverage big data, predictive analytics, and other advanced techniques to create highly efficient enterprise solutions for clients.

Data Management

Machine learning is crucial to our fintech solutions. ML capabilities enable banks and other financial institutions to boost productivity. They also help financial services providers to prevent fraud, manage risks, and forecast profits and revenue, among other things.

We Hold Expertise in

Our Data Analysis Process

We follow an agile approach to make the best out of every decision made in different departments of your company. We are committed to delivering realistic and game-changing insights, analytics, reports, BI and predictive analysis with precision and diligence to solve existing as well as potential problems.

- Data Requirement Elicitation

- Data Collection

- Data Cleaning

- Data Analysis

- Data Optimization

- Implementation and Monitoring