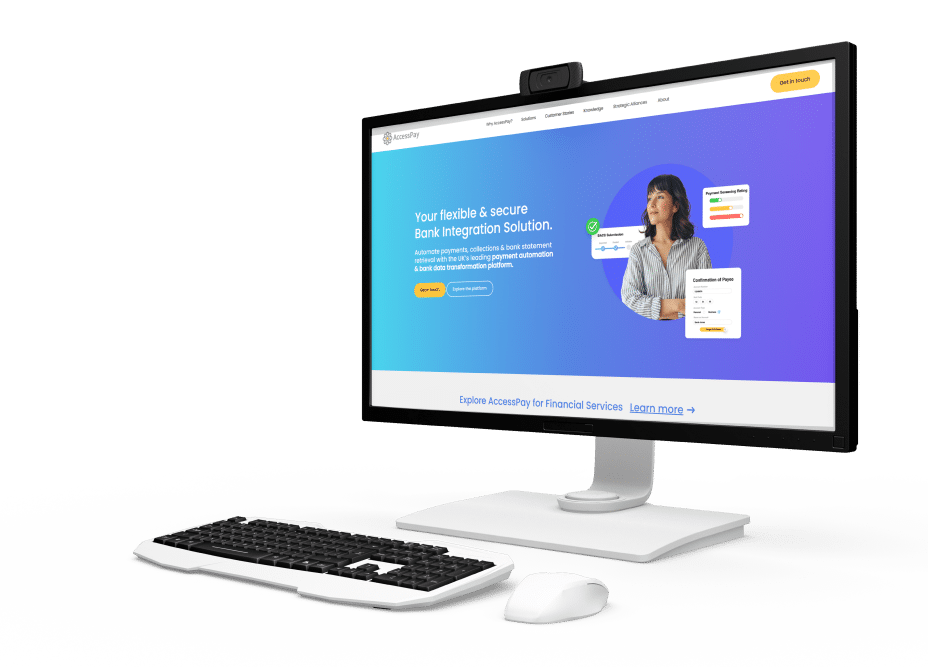

Our client is one of the most reputed digital providers of applications and innovative solutions for banks and corporates in whole UK. They specialize in middleware solutions, community-based banking, and internet banking delivered in cloud environments. The company delivers custom banking-specific digital platform including cash management and payments automation. Our client serves a wide range of sectors including banking, corporates. Their banking solutions are recognized as one of the world’s most innovative ones, disrupting the conventional banking sector with new customer-focused services. The company contacted OrangeMantra to strengthen their development team with Angular expertise in automation of banking processes.

Retail & FMCG

Digital Banking & Finance

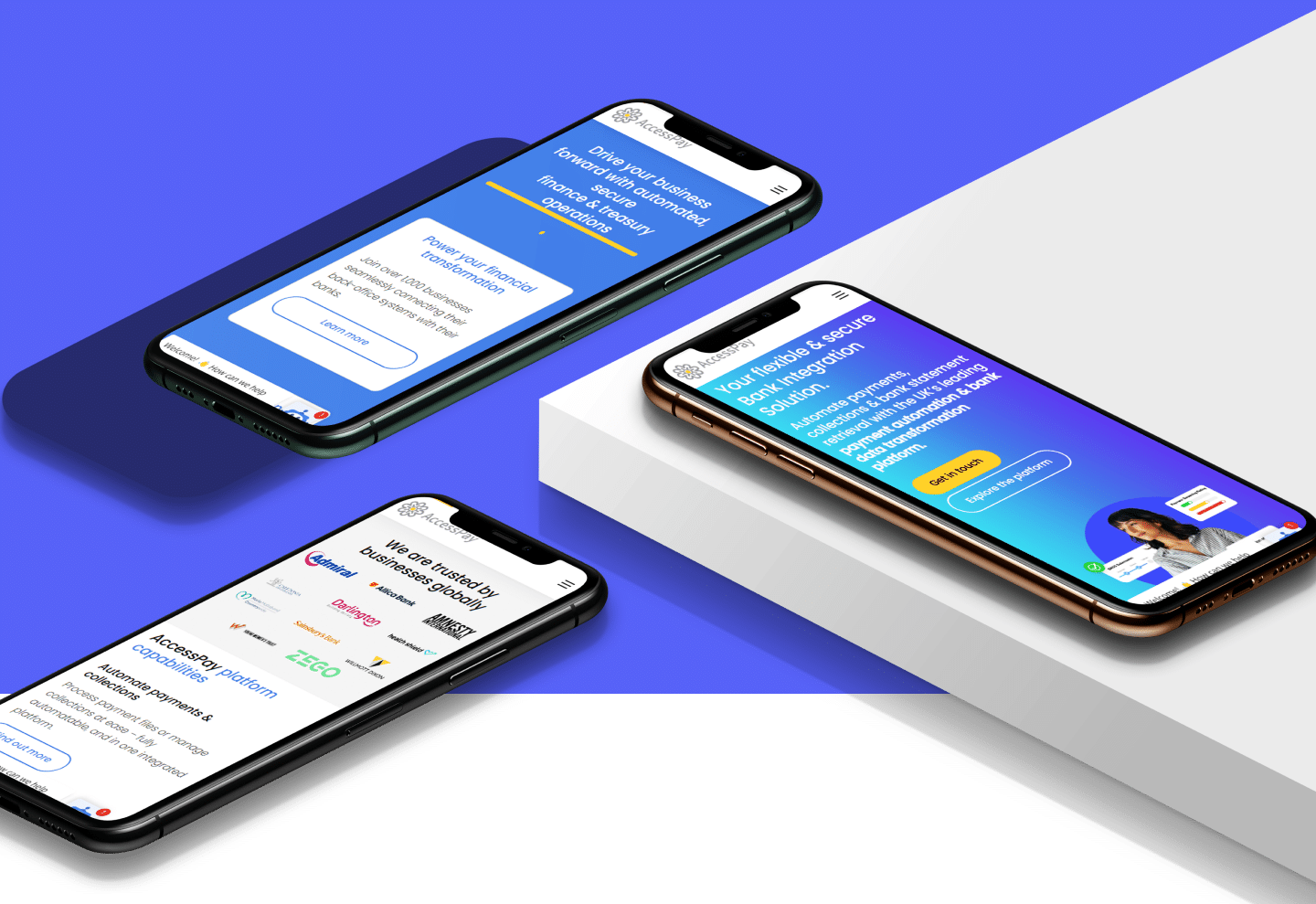

Within the first months of our collaboration, our team started customizing the banking platform and tailoring solutions to meet the automation needs. First, we integrated a solution to ease cash management and automate bank statements. For this, we also customized two-factor authentication processes for payouts and set up the important settlement process. The security of payments is guaranteed by Digital Enablement Service that manages, generates, and provisions digital payment credentials to mobile devices. OrangeMantra also implemented an advanced authorization feature for additional security dimension to contactless payments. In addition, we’ve also built a QA process to ensure the newly developed banking automation solution works faultlessly and offers a positive user experience.

Conduct a thorough analysis of the client’s existing banking platform and automation needs. Identify pain points and areas for improvement for payment automation.

Assigned a team with Angular development expertise into the client’s team. Collaborate closely with the client’s stakeholders for seamless integration process.

Implement a robust two-factor authentication system to enhance the transaction security. Ensure compatibility with existing systems and a user-friendly customer experience.

Worked towards a comprehensive Quality Assurance process to identify and resolve potential issues. Conducted functional testing, security testing, and user acceptance testing.

The initial challenge for the client was to build the banking platform to handle a surge in new services and custom solutions for a large community of users.

Another concern faced by client was to ensure the highest level of security for digital payment processes and sensitive financial data.

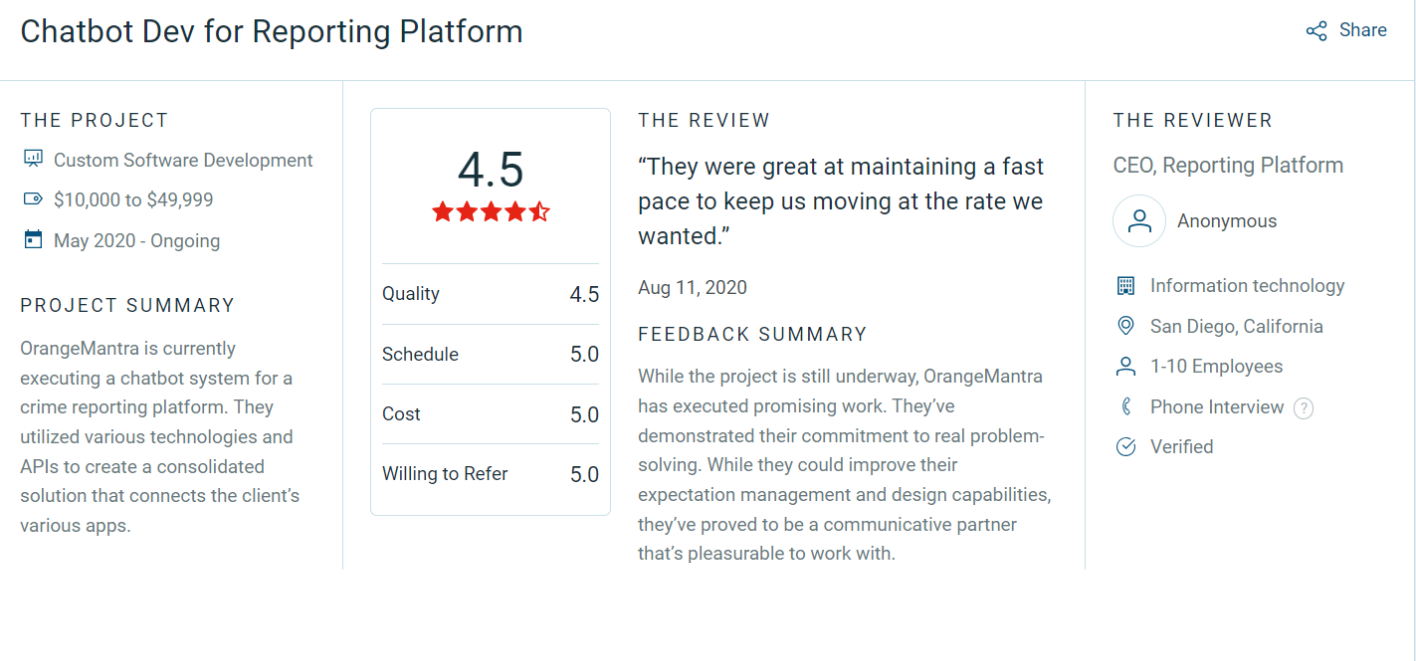

The secure payment technology powered solution was successfully released and accepted by end customers. Our team is currently collaborating on extending project capacity to integrate advance features and customization requests. By diversifying our client’s banking automation portfolio, we’re helping to increase their competitiveness in the dynamic finance industry.

Convenient contactless payments at thousands of merchants all across UK. Payment by phone even when offline thanks to advance authorization features in the mobile device. Advanced fraud protection and elimination of human interference for backend operations with automation features.

The secure payment technology-powered solution was successfully released and well-received by end customers.

OrangeMantra continues to collaborate with the client, enhancing project capacity to integrate latest features and cater to customization needs.

By diversifying the client’s banking automation portfolio, OrangeMantra contributes to growing their competitiveness in the competitive finance industry.